The following information is provided in accordance with Texas State Statute 2256.0016. Please refer to the disclosure at the bottom of this webpage for more information.

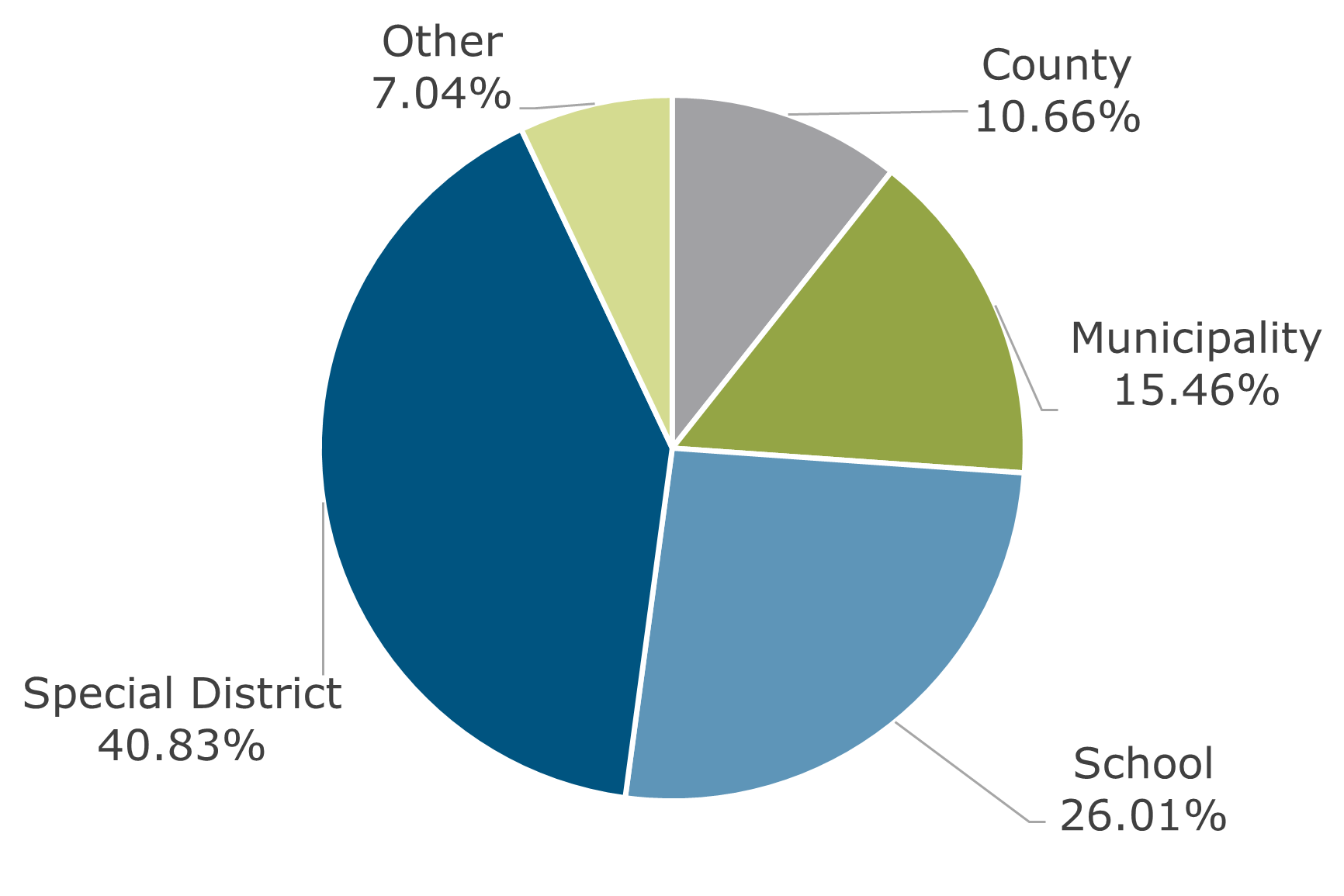

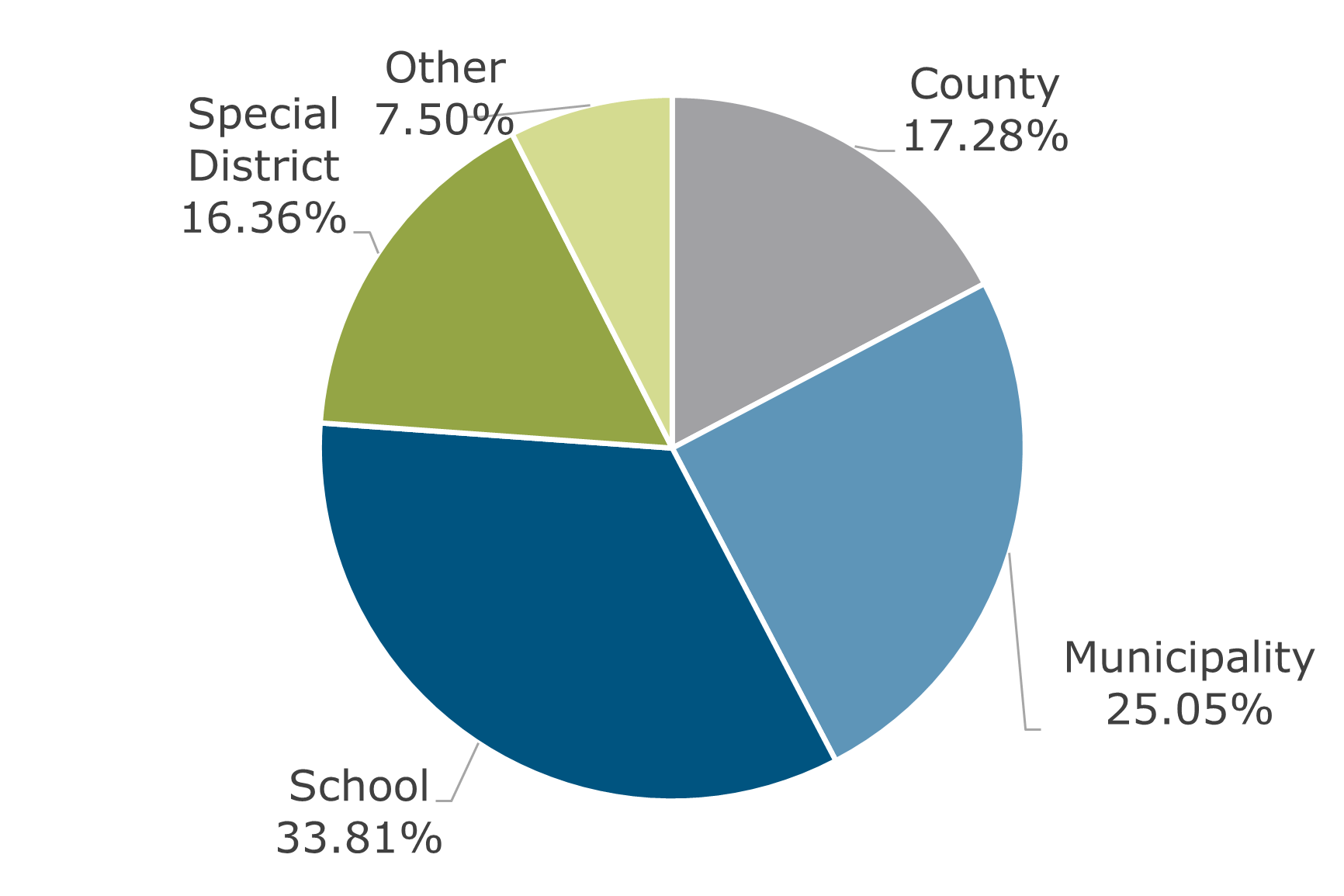

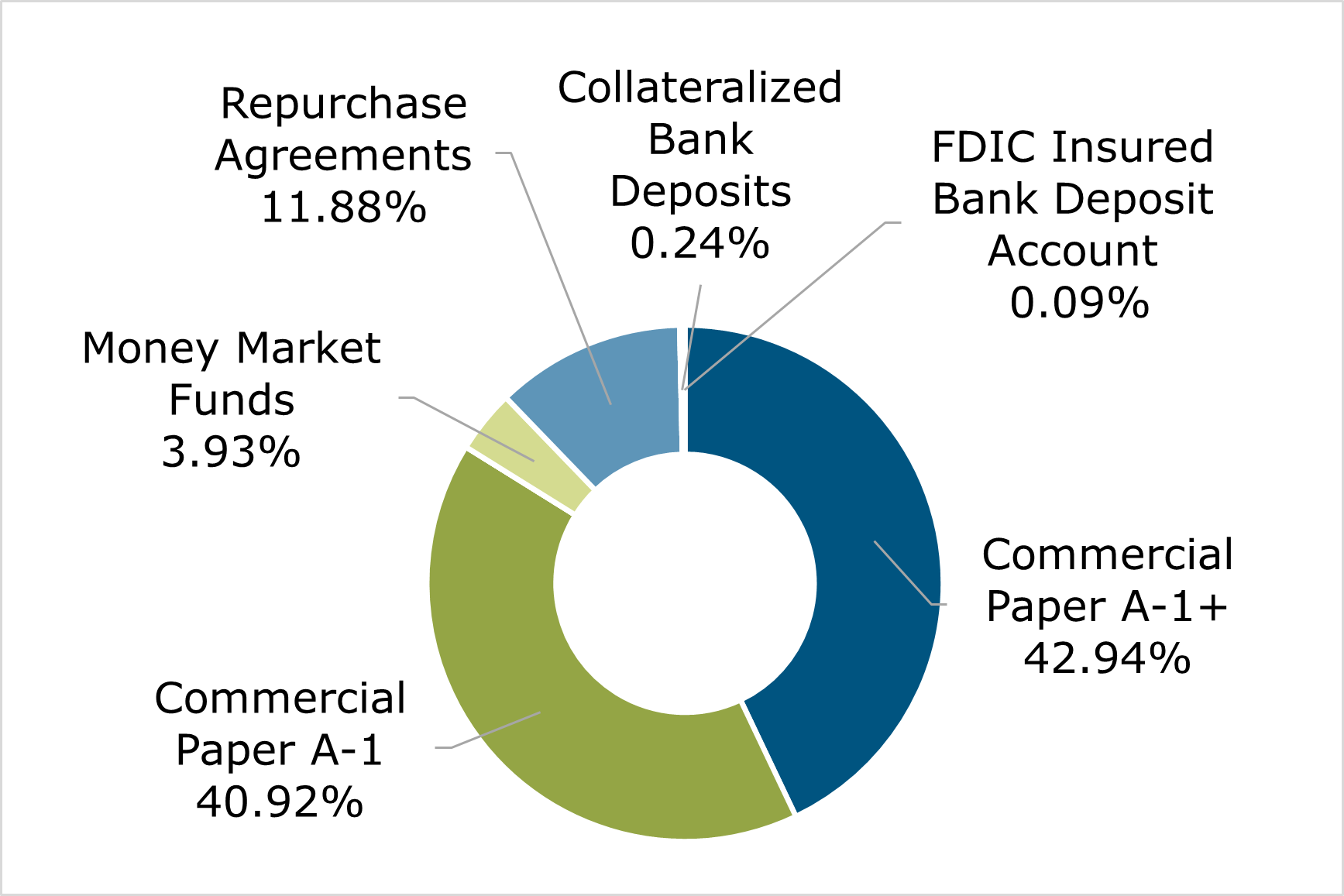

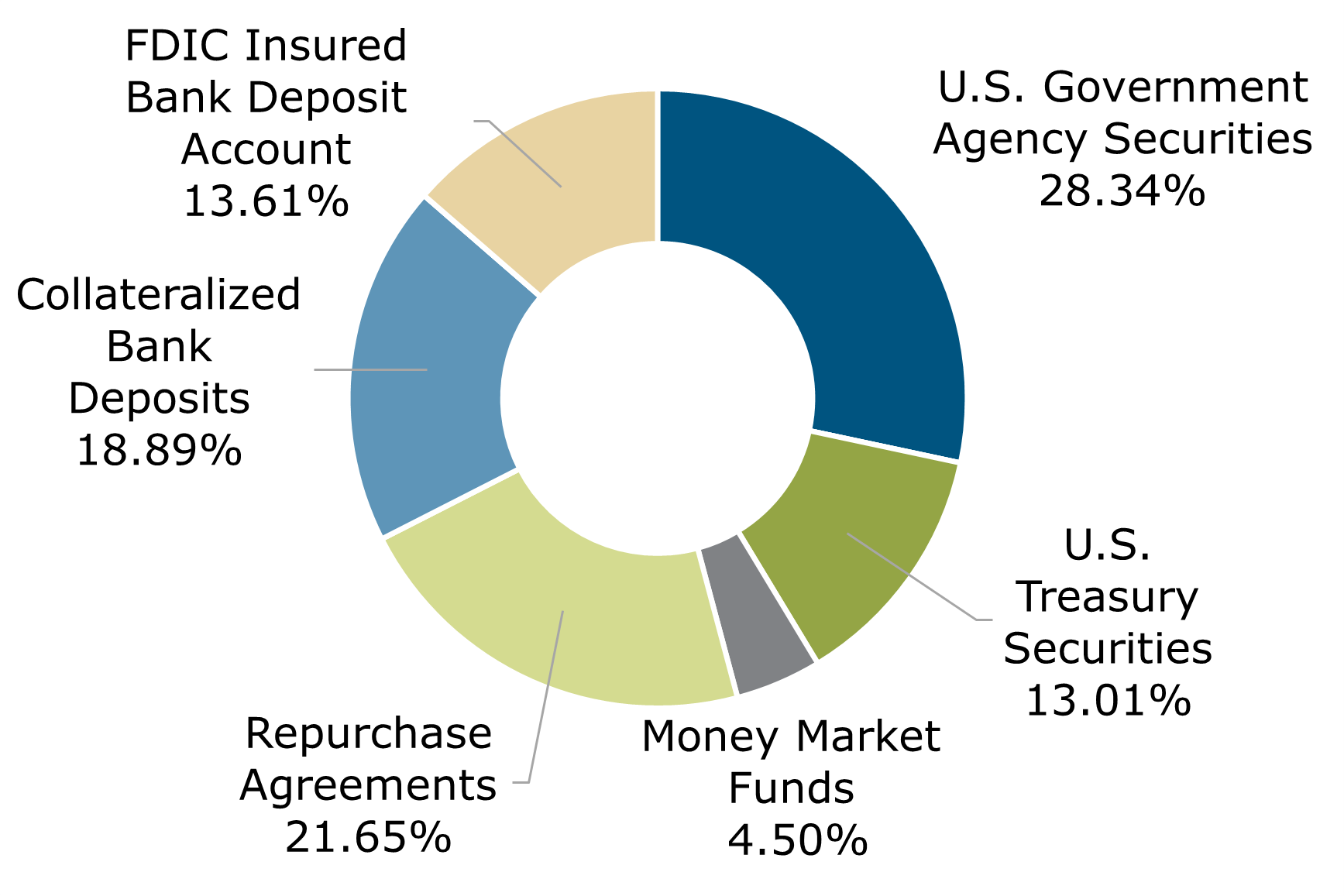

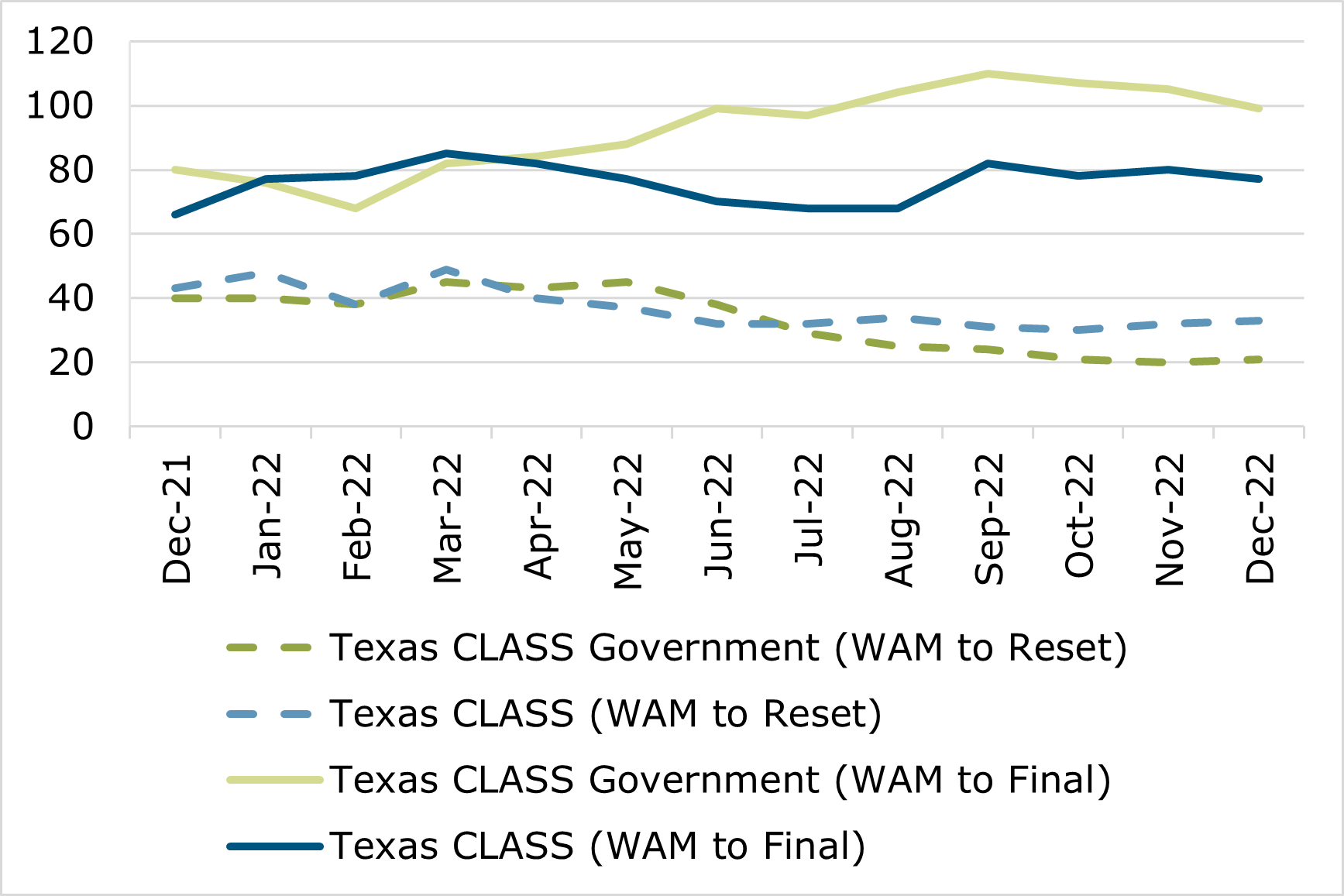

As of December 31, 2022

The following information is provided in accordance with Texas State Statute 2256.0016. Please refer to the disclosure at the bottom of this webpage for more information.

As of December 31, 2022

| Month End |

Average Yield** |

Month Ending Assets |

Share Balance |

Market Value |

Amortized Cost |

NAV | WAM (Reset)*** |

WAM (Final)*** |

| Oct-22 | 3.23% | $16,015,503,501 | 16,028,607,555 | $16,058,448,347 | $16,071,552,401 | 1.00 | 30 | 78 |

| Nov-22 | 3.85% | $16,061,748,292 | 16,067,425,694 | $16,216,520,404 | $16,222,197,806 | 1.00 | 32 | 80 |

| Dec-22 | 4.32% | $16,735,869,317 | 16,736,753,871 | $16,714,964,184 | $16,715,843,514 | 1.00 | 33 | 77 |

**Average monthly yield ***As of the end of the last day of the month

| Month End |

Average Yield** |

Month Ending Assets |

Share Balance |

Market Value |

Amortized Cost |

NAV | WAM (Reset)*** |

WAM (Final)*** |

| Oct-22 | 2.66% | $1,295,757,713 | 1,296,715,205 | $1,300,509,703 | $1,301,467,195 | 1.00 | 21 | 107 |

| Nov-22 | 3.40% | $1,319,054,970 | 1,319,771,779 | $1,323,623,320 | $1,324,340,129 | 1.00 | 20 | 105 |

| Dec-22 | 3.85% | $1,346,420,061 | 1,346,833,073 | $1,343,740,300 | $1,344,153,317 | 1.00 | 21 | 99 |

**Average monthly yield ***As of the end of the last day of the month

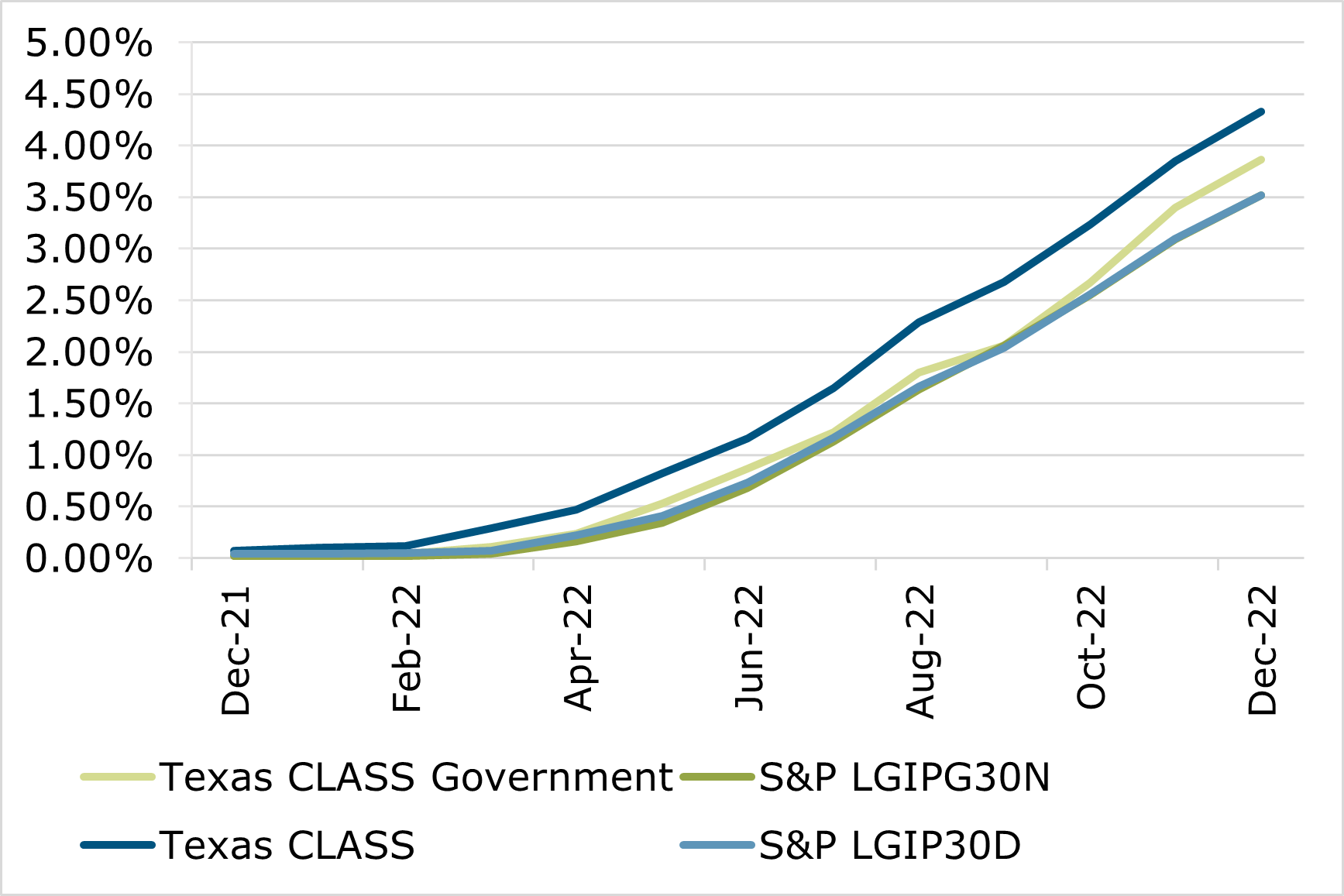

Texas CLASS |

Texas CLASS Government |

| January | 2022 | 0.0965% | | | January | 2022 | 0.0332% |

| February | 2022 | 0.1229% | | | February | 2022 | 0.0383% |

| March | 2022 | 0.2857% | | | March | 2022 | 0.1118% |

| April | 2022 | 0.4720% | | | April | 2022 | 0.2409% |

| May | 2022 | 0.8130% | | | May | 2022 | 0.5260% |

| June | 2022 | 1.1577% | | | June | 2022 | 0.8659% |

| July | 2022 | 1.6392% | | | July | 2022 | 1.2178% |

| August | 2022 | 2.2891% | | | August | 2022 | 1.7930% |

| September | 2022 | 2.6789% | | | September | 2022 | 2.0597% |

| October | 2022 | 3.2287% | | | October | 2022 | 2.6613% |

| November | 2022 | 3.8546% | | | November | 2022 | 3.3967% |

| December | 2022 | 4.3170% | | | December | 2022 | 3.8505% |

For the month of December 2022, the Program Administrator accrued fees of $1,296,373.68 and had average shares outstanding of 16,292,807,751.57 for Texas CLASS. For Texas CLASS Government, the Program Administrator accrued fees of $132,628.57 and had average shares outstanding of 1,328,712,236.11. The fees for both Texas CLASS and Texas CLASS Government are accrued on a daily basis. The applicable fee rate is calculated by taking the fee rate(s) divided by 365 days (366 days in the event of a leap year) and rounded to ten decimal places. The current day’s settled shares outstanding will be multiplied by the applicable fee rate(s) to equal the daily fee accrual. For weekend days and holidays, the settled shares outstanding for the previous business day will be utilized for the calculation of the fees. The applicable fee rate is located in Exhibit F of the Ninth Amended and Restated Trust Agreement. The Program Administrator reserves the right to abate fees listed in the Ninth Amended and Restated Trust Agreement. The monthly fee is the sum of all daily fee accruals for the month of December. The fees are paid monthly upon notification to the custodian bank. As of December 31, 2022 the fee for Texas CLASS was 9 basis points and the fee for Texas CLASS Government was 12 basis points.

Data unaudited. Charts may not equal 100% due to rounding. Performance results for both Texas CLASS and Texas CLASS Government are shown net of all fees and expenses and reflect the reinvestment of interest and other earnings. Many factors affect performance including changes in market conditions and interest rates and in response to other economic, political, or financial developments. Investment involves risk including the possible loss of principal. No assurance can be given that the performance objectives of a given strategy will be achieved. All comments and discussion presented are purely based on opinion and assumptions, not fact. These assumptions may or may not be correct based on foreseen and unforeseen events. The information presented should not be used in making any investment decisions. This material is not a recommendation to buy, sell, implement, or change any securities or investment strategy, function, or process. Any financial and/or investment decision should be made only after considerable research, consideration, and involvement with an experienced professional engaged for the specific purpose. Texas CLASS is not a bank. An investment in Texas CLASS is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although Texas CLASS seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. Past performance is not an indication of future performance. Any financial and/or investment decision may incur losses. A ‘AAAm’ rating by S&P Global Ratings is obtained after S&P evaluates a number of factors including credit quality, market price exposure, and management. Ratings are subject to change and do not remove credit risk. Click here for more information.

*The benchmark, the S&P US AAA & AA Rated GIP All 30 Day Net Yield (LGIP30D) is a performance indicator of rated GIPs that maintain a stable net asset value of $1.00 per share and is an unmanaged market index representative of the LGIP universe. The S&P benchmark utilized in this comparison is a composite of all rated stable net asset value pools. GIPs in the index include only those rated based on S&P’s money market criteria. Pools rated ‘AAAm’ provide excellent safety and a superior capacity to maintain principal value while those rated ‘AAm’ offer very good safety and a strong capacity to maintain principal value (Source: S&P Global Ratings’ website). The comparison between this index and the portfolio may differ in holdings, duration, fees, and percentage composition of each holding. Such differences may account for variances in yield.

*The benchmark, the S&P AAA & AA Rated GIP Govt 30 Day Net Yield (LGIPG30N) is a performance indicator of rated GIPs that maintain a stable net asset value of $1.00 per share and is an unmanaged market index representative of the LGIP universe. The S&P benchmark utilized in this comparison is comprised of pools that invest in U.S. Government securities, U.S. Treasury securities, Repurchase agreements collateralized by U.S. government and treasury securities or any combination of the above. GIPs in the index include only those rated based on S&P’s money market criteria. Pools rated ‘AAAm’ provide excellent safety and a superior capacity to maintain principal value while those rated ‘AAm’ offer very good safety and a strong capacity to maintain principal value (Source: S&P Global Ratings’ website). The comparison between this index and the portfolio may differ in holdings, duration, fees, and percentage composition of each holding. Such differences may account for variances in yield.

Calculation methodology for the LGIP30D and LGIPG30N is the monthly average of the each week’s 30-day average rate as provided by Bloomberg. An investor cannot invest directly in an index.