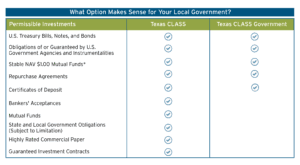

Texas CLASS offers two distinct investment options for local units of government in the State of Texas. Participants are able to invest in one or both funds based on their particular investment needs. This includes the ability to transfer funds between Texas CLASS and Texas CLASS Government.